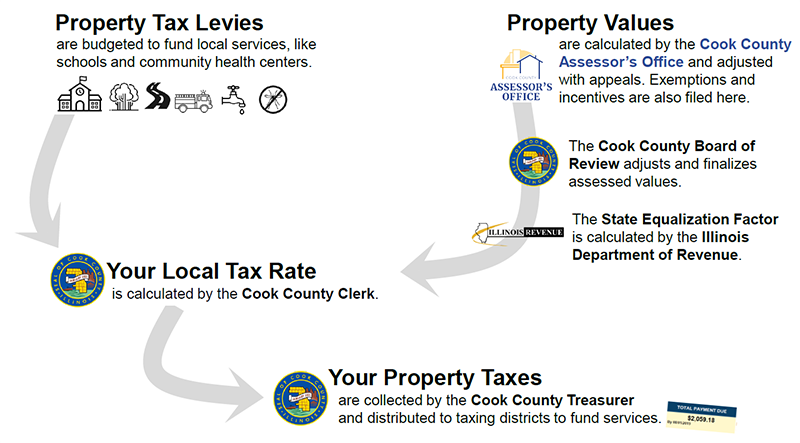

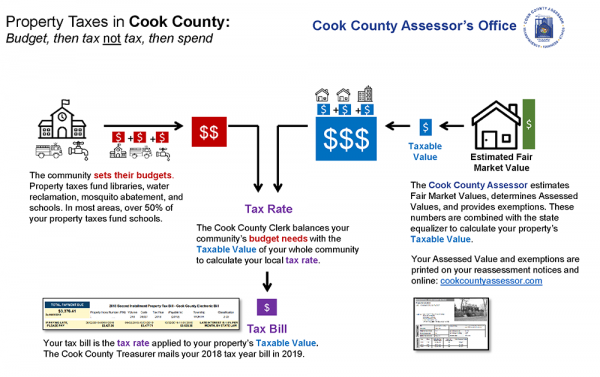

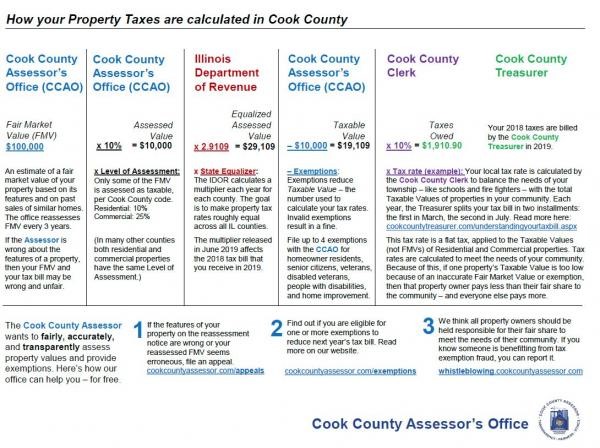

Property Taxes are determined by the value of your property and the type of property it is. If property value goes up then taxes go up.

There are 3 moving parts that determine how much you pay, the value of your home, the equation to determine the taxes and exemptions.

- Value of home based on market, the assessor’s office, and board of review

- The formula set by the varying levels of government

- Exemptions set by the state of Illinois

- The levels set by different municipalities

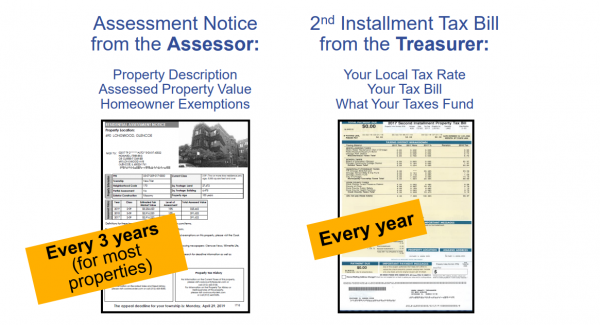

Residents pay the taxes in 2 installments. The second installment is where the exemptions come into effect. The first installment is usually 55% of what you pay for the year.

Properties are reassessed on a 3-year cycle (1/3rd of the county each year). Jefferson Township’s and West Chicago’s following assessment is in 2024. All appeals will apply for the time remaining between 3-year cycles.

- The Cook County Assessor’s Office calculates a fair market value for your property. In calculating fair market value for residential properties, they consider what the fair cash value would be for your property if it had sold recently in its reassessment year.

- The Assessor’s estimate of your home’s fair market value is based on two things: your home’s characteristics, and patterns between how other homes’ characteristics affected their sale values. The Assessor uses recent sales of homes similar to yours, in and around your neighborhood, to estimate your home’s value. Homes more similar to yours, or closer geographically to yours, make more of a difference in our calculation than other homes.

- Because sale values of homes are affected by their characteristics – such as its square footage, age, and location – the Assessor uses statistical modeling to use those characteristics to produce property values for each home. Their assessment models consider several different characteristics of homes including, but not limited to, land, location, building square footage, and construction type.

- For residential properties, your property’s assessed value equals 10% of its fair market value, per Cook County ordinance.

Reassessment

- The Cook County’s Assessor’s Office is responsible for valuing the more than 1.8 million parcels in Cook County. Illinois law requires that the estimated property value and assessed valuation of your property be periodically updated for real estate tax purposes.

- Cook County is divided into three areas, the northern suburbs, southern suburbs, and the City of Chicago. Each of these areas is valued once every three years. Furthermore, Cook County is divided into 36 townships for assessment purposes. You can find your township at this link.

- All of Chicago will be reassessed in 2024, which means you should receive a reassessment of your property. This reassessment will look like the sample below.

- If the characteristics listed for your home are wrong, if you think your home is worth less than the fair market value on this notice, or if you think there is information about your home that was not taken into account, you can file an appeal of your assessment.

- Appeals can be filed with the Assessor’s office or with the Cook County Board of Review. Please see the How To Save Money section to learn more.

https://www.cookcountyassessor.com/assessment-calendar-and-deadlines

You can check your home’s assessed value at this link